CBAM Carbon Border Adjustment Mechanism? If you export into EU or if you import as an EU company from outside EU, you are concerned because it means: risk to pay. But also exporting CO2 to the US will face new laws.

US congress discusses currently a law similar to EU’s CBAM: The 2025 Foreign Pollution Fee Act. Which would induce a tariff for Belgian, Luxembourg or West Balkan countries of 50 % on iron and steel and 100 % for solar products.

The EU approach with CBAM is different: you have to demonstrate the CO2 content. What might by easy for a water power station exporting electricity is a nightmare for a complex products consisting of thousands of parts.

The EU, aware of this, is already mulling exceptions and simplifications. The Commission proposes to simplify CBAM for small CBAM importers, mostly SMEs and individuals, by introducing a new CBAM de minimis threshold exemption of 50 tonnes mass. These are importers who import small quantities of CBAM goods, representing very small quantities of embedded emissions entering the EU from third countries. This means keeping around 99 % of emissions still in the CBAM scope, while exempting around 90 % of the importers. For those importers who remain in the CBAM scope, the proposed changes will also facilitate compliance with CBAM obligations. For instance, by simplifying the authorisation of declarants, the calculation of emissions, and the management of CBAM financial liability.This will be coupled with measures making CBAM more effective, by strengthening anti-abuse provisions and developing a joint anti-circumvention strategy together with national authorities.

Only a few sectors are concerned. The largest area are cement, fertilizer, alloy and electricity. But most relevant is the new regulation for complex steel products: Goods made from various steel parts, from robots to machinery, where calculating the CO2 content is a nightmare.

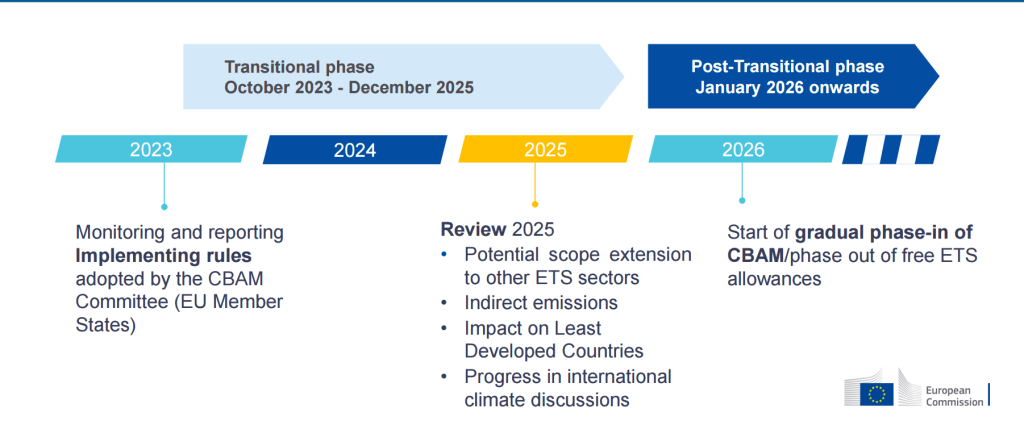

CBAM is the EU’s key tool to put a fair price on the carbon emissions embedded in imported goods. For businesses, CBAM means new reporting obligations and processes.

To support companies, business support organizations, and authorities in understanding and applying CBAM, GIZ North Macedonia via the EU for Economic Growth (EU4EG) Project, is organizing a dedicated online course.

Inform yourself and make the challenge an opportunity for your business!

📅 Thursday, 22 May 2025

🕐 13:00 – 15:00 CEST

📍 Online

In this practical session, participants will:

✅ Get a clear overview of CBAM regulations and reporting requirements

✅ Learn how CBAM impacts trade with the EU

✅ Receive step-by-step guidance on compliance tools

To register for the free course, send an email to EU4eg@GIZ.de with the subject: “CBAM online training” including: Surname, Name and Organization till May 21st, 12:00 CEST

For more information about CBAM, find process charts, implementation guidelines etc. on our website here.

An insight on the US Carbon Tariff Proposal, an US press release and a “Need to Know Sheet” are linked.

Leave a comment